Demystifying Inventory Audits

An inventory audit is a comprehensive review and verification of a company's physical inventory against its recorded financial records. This process ensures accuracy, identifies discrepancies, and helps maintain an accurate account of available assets. It is one of the essential steps that cannot be left out when preparing financial statements. But for startups new to business operation, inventory audit might feel unfamiliar. What is inventory auditing, and why is it conducted? From the procedure to its significance, let's look into it step by step!

Inventory Audit, a Key Tool in Evaluating Business Performance

Inventory is an important asset of a company. Especially for companies that earn profit through commerce, it can be called the most essential asset. Inventory auditing, an integral aspect of the accounting audit, involves a meticulous examination of this critical asset. It extends beyond digital records; the auditor (accountant) conducts on-site warehouse visits to assess the physical state of the inventory. Through this process, the auditor reviews the company's inventory and accurately grasps the financial situation. Companies that meet certain criteria for external audits must mandatorily undergo accounting audits, including inventory audits.

Why is Inventory Audit Important in Corporate Accounting? It's because the inventory asset serves as integral data for assessing company profitability when formulating financial statements. The closing inventory amount and cost of goods sold can only be confirmed by examining whether the actual inventory matches the recorded inventory, and the business should figure out the cost of goods sold (COGS) to calculate gross profit. Gross profit refers to the financial metric that represents the difference between a company's total revenue from sales and its cost of goods sold. Later, these data are used as evidence to verify the appropriateness of the financial statements prepared by the company.

Cash Flow Statement and Calculator

For novice entrepreneurs who might encounter terms such as closing inventory amount and cost of goods sold that seem unfamiliar, let's clarify the key terms essential for comprehending inventory audits. The terms related to inventory auditing include opening inventory, purchase of the current period, closing inventory, cost of goods sold, and gross profit.

- Opening Inventory: The value of goods held at the start of a specific accounting period, such as a fiscal year or a financial reporting period.

- Purchase of the Current Period: The value of newly purchased goods during the reporting period

- Closing Inventory: The value of goods still has on hand at the end of a specific accounting period.

- Cost of Goods Sold (COGS): The direct cost incurred by a company to produce or purchase the goods or products that have been sold during a specific accounting period.

- Gross Profit: The total profit earned from selling goods

The opening inventory and the purchase of the current period can be easily ascertained through transaction details, etc., but calculating the cost of goods sold for every product sold can be challenging. Therefore, a company calculates the total cost of goods sold during the accounting period by subtracting the inventory remaining unsold at the end of a specific accounting period such as year-end (closing inventory) from the original inventory (opening inventory) and newly purchased goods (purchase of the current period). To summarize this calculation method using arithmetic symbols, it is as follows:

If you solely depend on computerized records and fail to adequately verify the ending inventory assets, it can diminish the credibility of the cost of goods sold. Therefore, you must directly observe the actual inventory to accurately determine the closing inventory and cost of goods sold. That's why an inventory audit is conducted once a year, as part of an accounting audit.

Identify Shrinkage Losses through Comprehensive Stocktaking

When verifying the quantity of inventory with an auditor, it is rare to conduct a complete census of all the inventory in the warehouse. For efficiency, some inventory samples are drawn to compare with the computerized inventory. However, it is common for a company facing an inventory audit to conduct an inventory inspection internally, checking the entire stock quantity.

Stocktaking refers to the procedure of counting physical inventory one by one and reviewing whether it matches the computerized stock quantity. The company proactively examines for disparities between recorded quantities and physical stock, labeling actual inventory to enhance audit efficiency.

Also, during the stocktaking process, shrinkage losses, where the physical inventory is less than the recorded inventory, are identified. Shrinkage loss refers to unintentional losses due to improper loading, theft, damage from long-term storage, etc.

Under general business accounting standards, losses occurring during regular business activities are treated as the cost of goods sold, while abnormal losses such as theft or fire are treated as non-operating expenses. If shrinkage losses included in the operating cost (cost of goods sold) are not properly identified, or if losses corresponding to operating and non-operating expenses are arbitrarily reclassified, it may lead to significant problems later on. Therefore, it is important to carefully verify the existence and cause of shrinkage losses through a thorough stocktaking.

For example, company A, which sells mattresses, had a recorded ending inventory of 100 units, but during the stocktaking, only 95 units were found in the warehouse. Out of the missing five units, three were found to have been stolen, and two were damaged during storage. In this case, the three stolen units are treated as non-operating expenses, and the two damaged units are treated as the cost of goods sold. If company A doesn't conduct a stocktaking and audit, it could lead to serious problems in accurately assessing the financial status of the company.

Optimize the Inventory Audit Process with the BoxHero Solution

BoxHero tracks all inbound and outbound transactions, consolidating inventory data as the digital records.

Simply access Reports > View Past Quantity on the sidebar to easily examine specific past inventory statuses. When conducting audits, it's common to compare current inventory levels with past year-end quantities. By clicking the End of Last Year button on the View Past Quantity page, you can quickly evaluate last year's year-end inventory status.

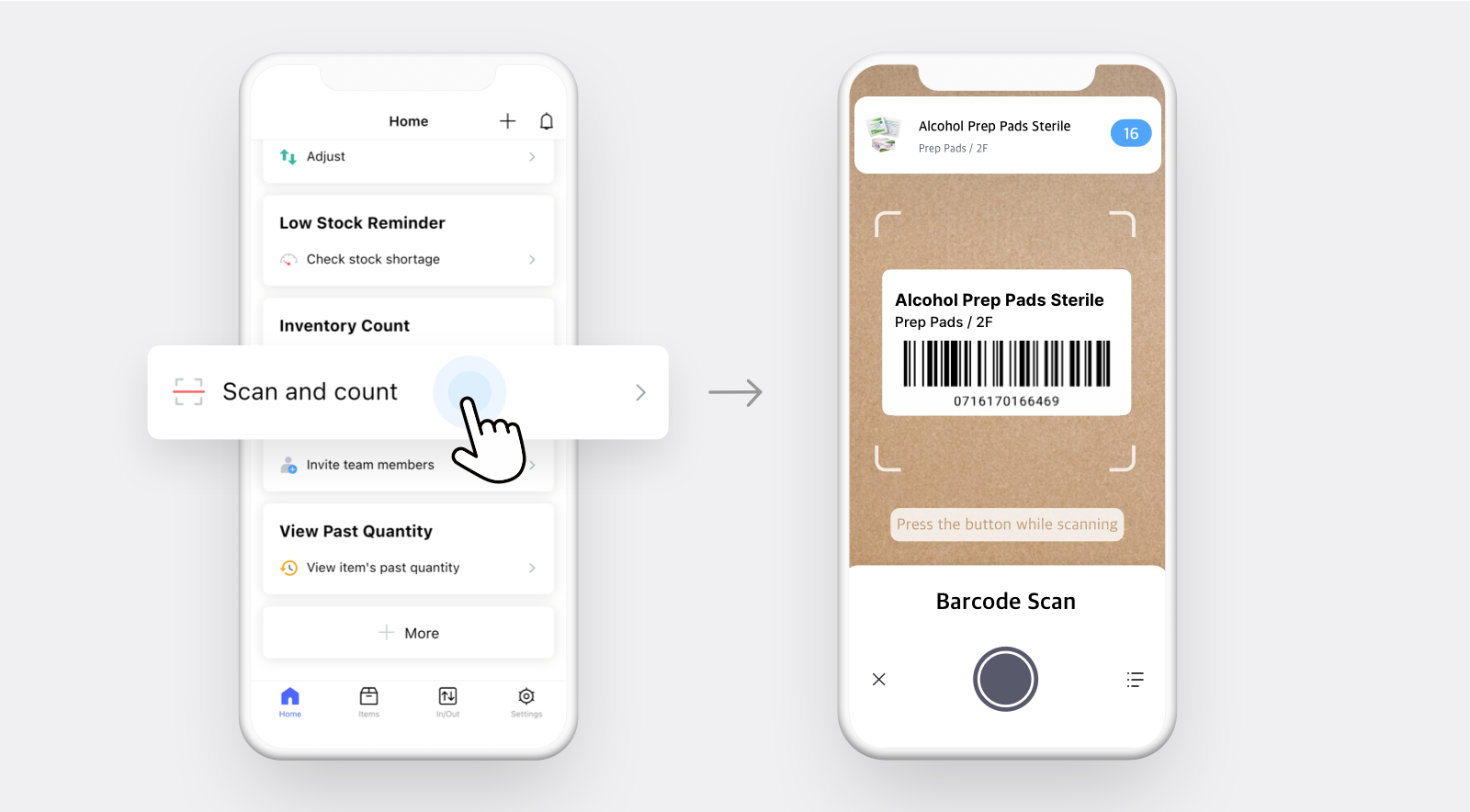

Furthermore, for internal stocktaking, use the mobile app's "Inventory count" feature for efficient and precise verification of all inventory quantities. Install the BoxHero mobile app and click Scan and Count button to start scanning the items barcodes using the in-app camera. This facilitates a convenient alignment between physical stocktaking and digital records.

An inventory audit is not just a formality or a process done for the sake of it. It's a crucial step to ensure the accuracy of a company's financial statements and give stakeholders, including investors and creditors, an accurate and transparent view of the company's financial health. By conducting an inventory audit, a company can identify discrepancies and shrinkage losses, ensure that the closing inventory and cost of goods sold are accurately determined, and validate the overall integrity of the financial statements. It's a key component in maintaining trust and credibility in the business world, especially for companies engaged in trading activities.

If you're a startup or a small business owner, it might feel like a complex and daunting task. However, understanding the importance of inventory auditing and how it fits into the larger picture of your financial health will make it an invaluable tool for managing and growing your business. Get ready for inventory audits with the dependable inventory management system, BoxHero, today!