Manage Purchase and Sales with BoxHero

Accounts receivable/payable management is an important part of keeping track of your business's income and expenses. It's also useful for tax purposes, so it's important to keep meticulous records and keep it organized. However, if you have multiple sources of purchase and sales, it can be a bit of a hassle. That's where BoxHero's Purchase & Sales feature comes in, to help you get started!

What is Purchase & Sales?

BoxHero supports features that allow you to manage all the processes of ordering, receiving, selling, and shipping in one solution: Bundles to manage different product configurations, Purchase to create and view purchase orders, and Sales to create and view sales invoices. If you've never used the Purchase & Sales features before, read on!

Tips for managing BoxHero's POs

1️⃣ Find your transaction statement by order number

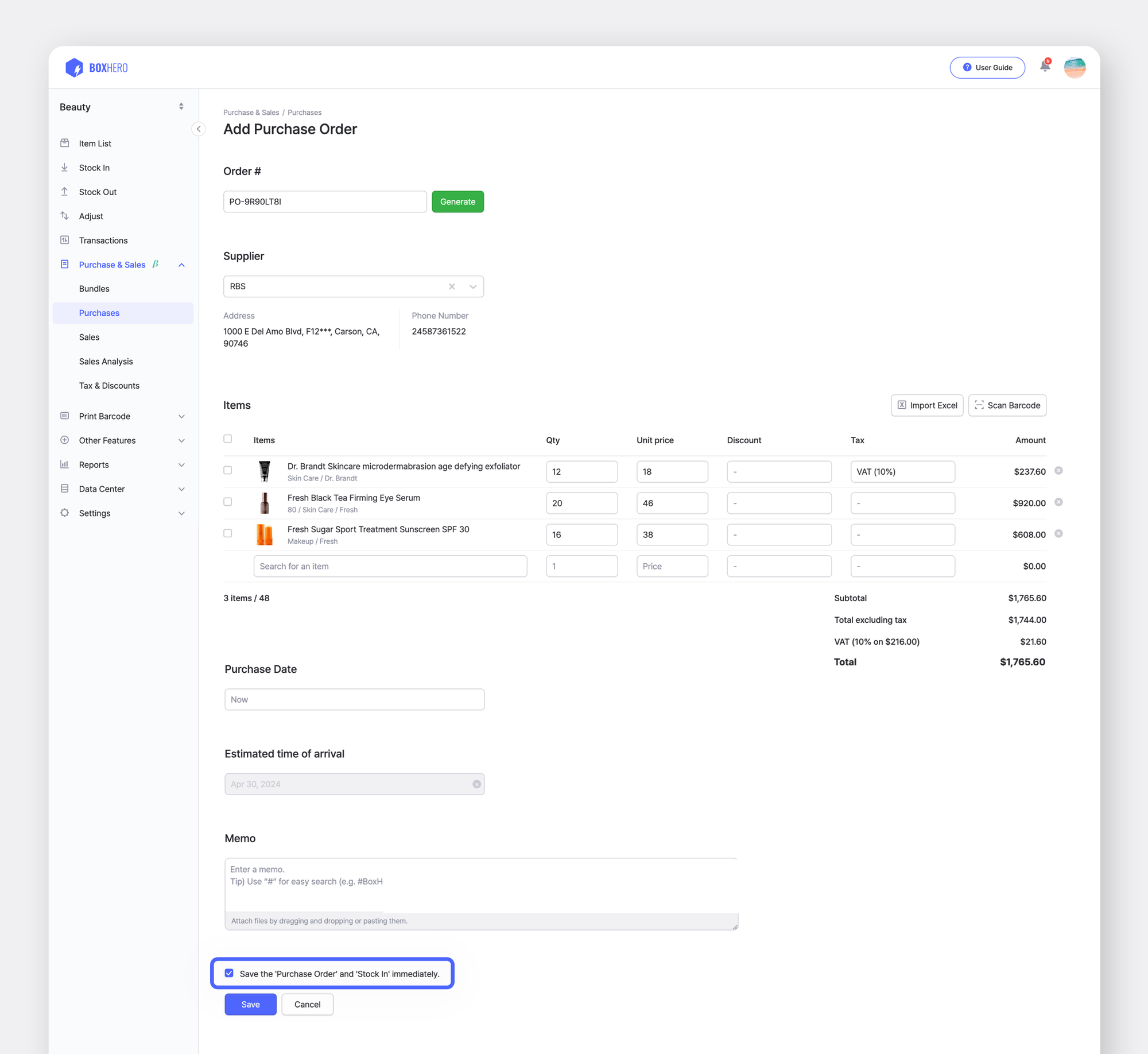

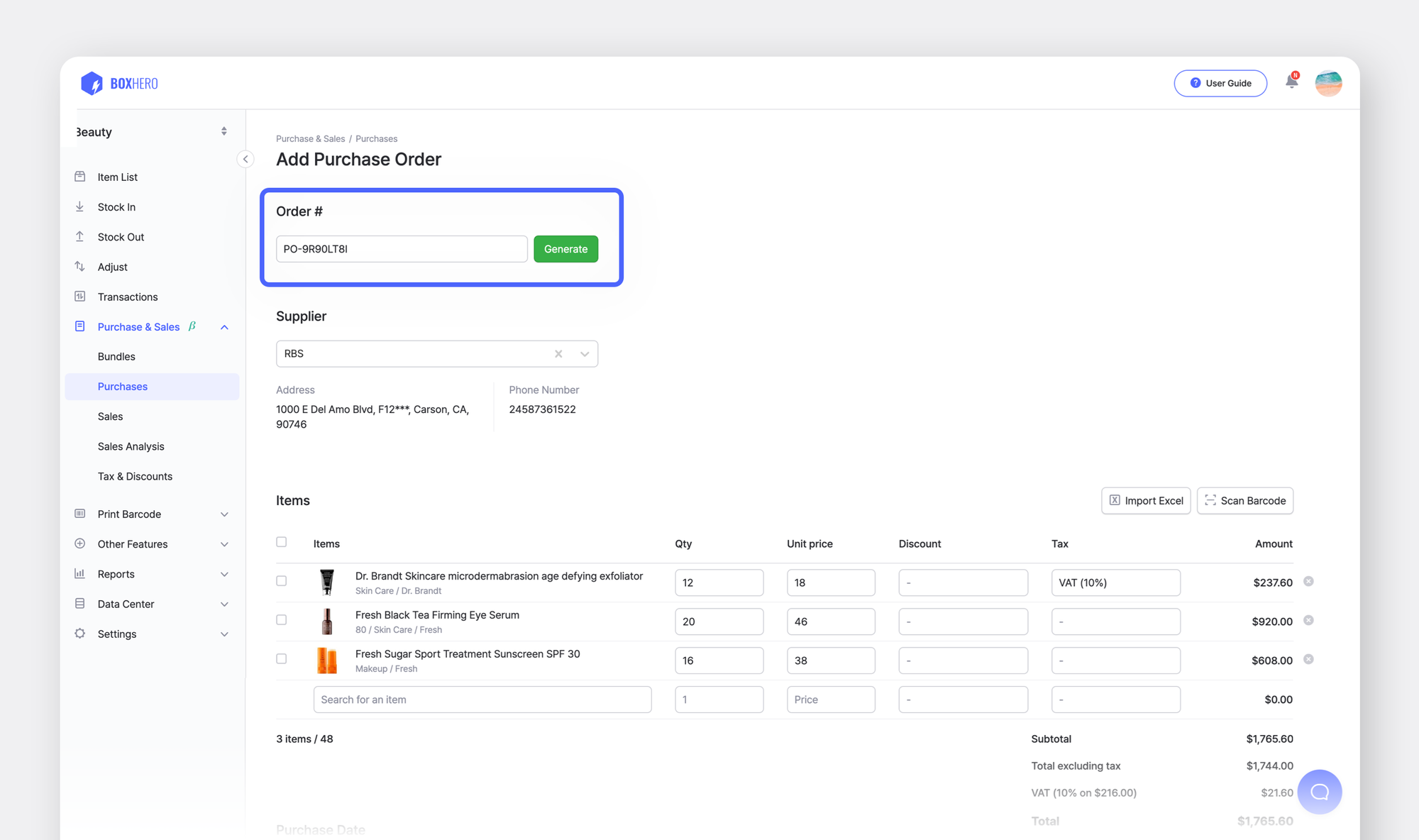

If you click on Purchase & Sales > Purchase > Add Purchase Order or Sales > Add Sales Order on the sidebar of BoxHero, you can easily create a purchase order and a sales order using the products you have registered in the product list.

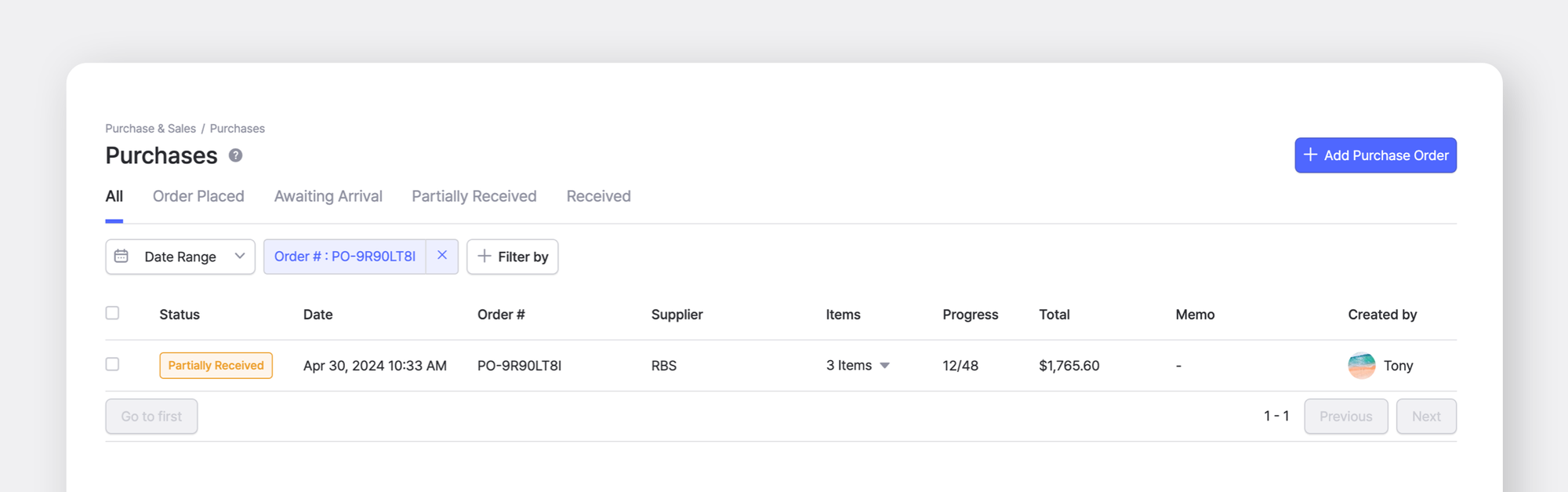

If you want to manage your transaction statements more conveniently, you can utilize order numbers. An order number is an identification number that allows you to easily look up transaction information such as orders, sales, etc. Just like a barcode allows you to see all the information related to a product at once, an order number allows you to quickly see the information related to a transaction. In BoxHero, you can enter your existing order number format or create a new order number to manage your transaction statements.

Generate to create one.Once you know the order number, you can search for the purchase order or sales order by tapping on Filter by > Order # on the Purchase or Sales tab. Click on the corresponding sales order, and then tap the three dots (...) icon on the right to utilize the sales order by emailing, printing, or exporting to Excel.

2️⃣ Applying taxes

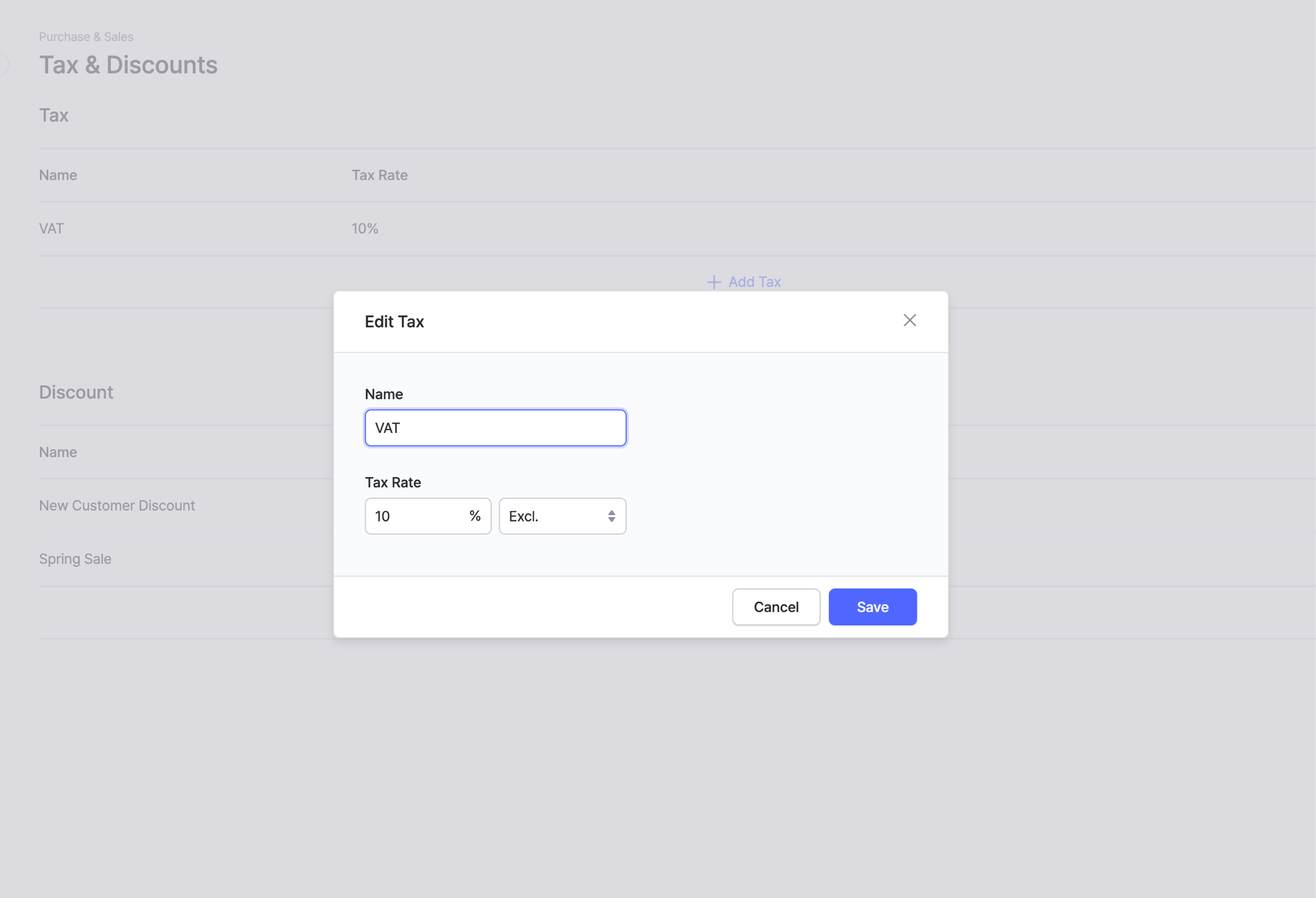

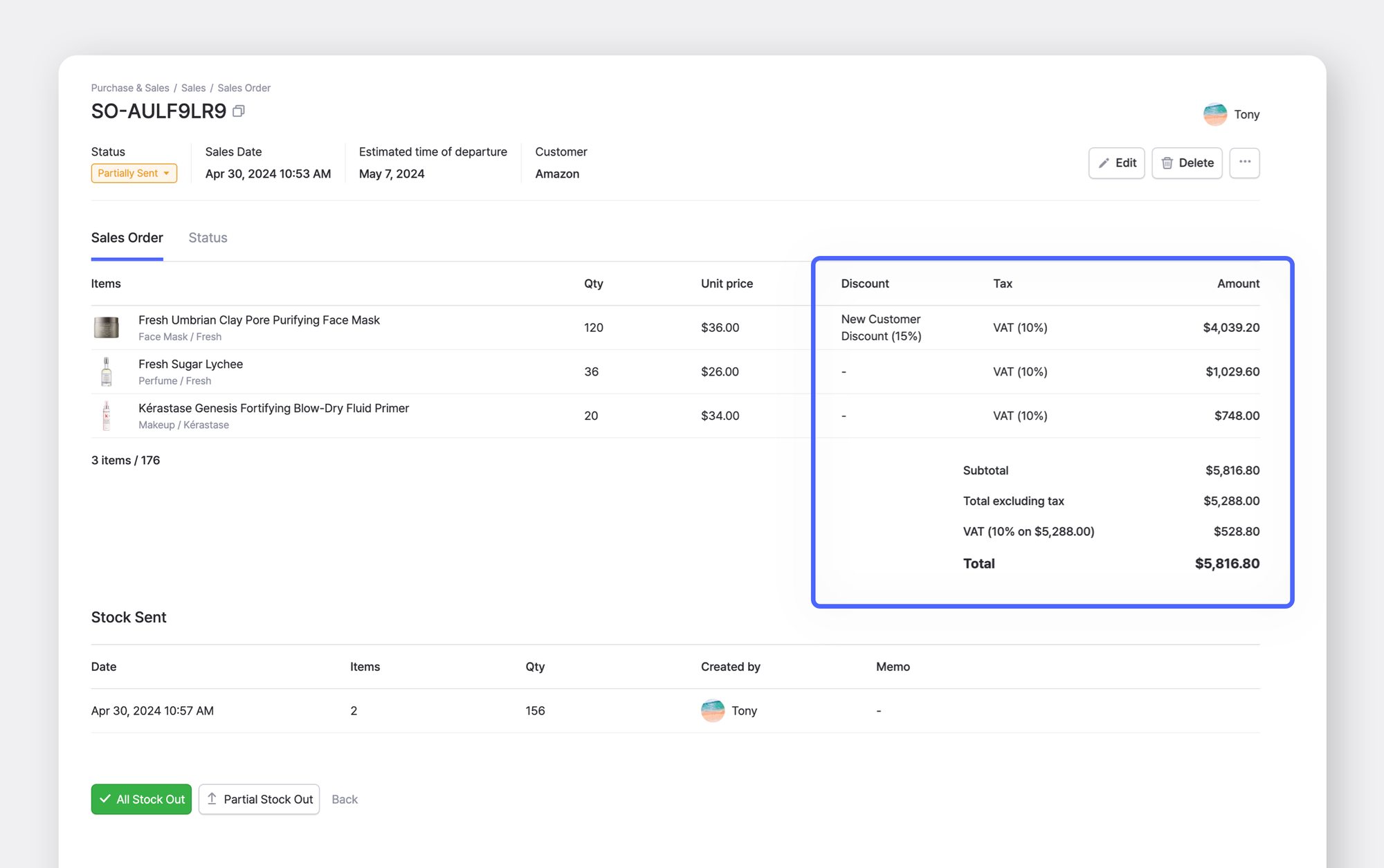

If you set the selling price without sales tax, you may end up with less revenue than you expected. Therefore, it's very important to keep taxes in mind when managing your accounts receivable. To help you manage your accounts receivable more conveniently, BoxHero has recently added a tax feature to Purchases & Sales.

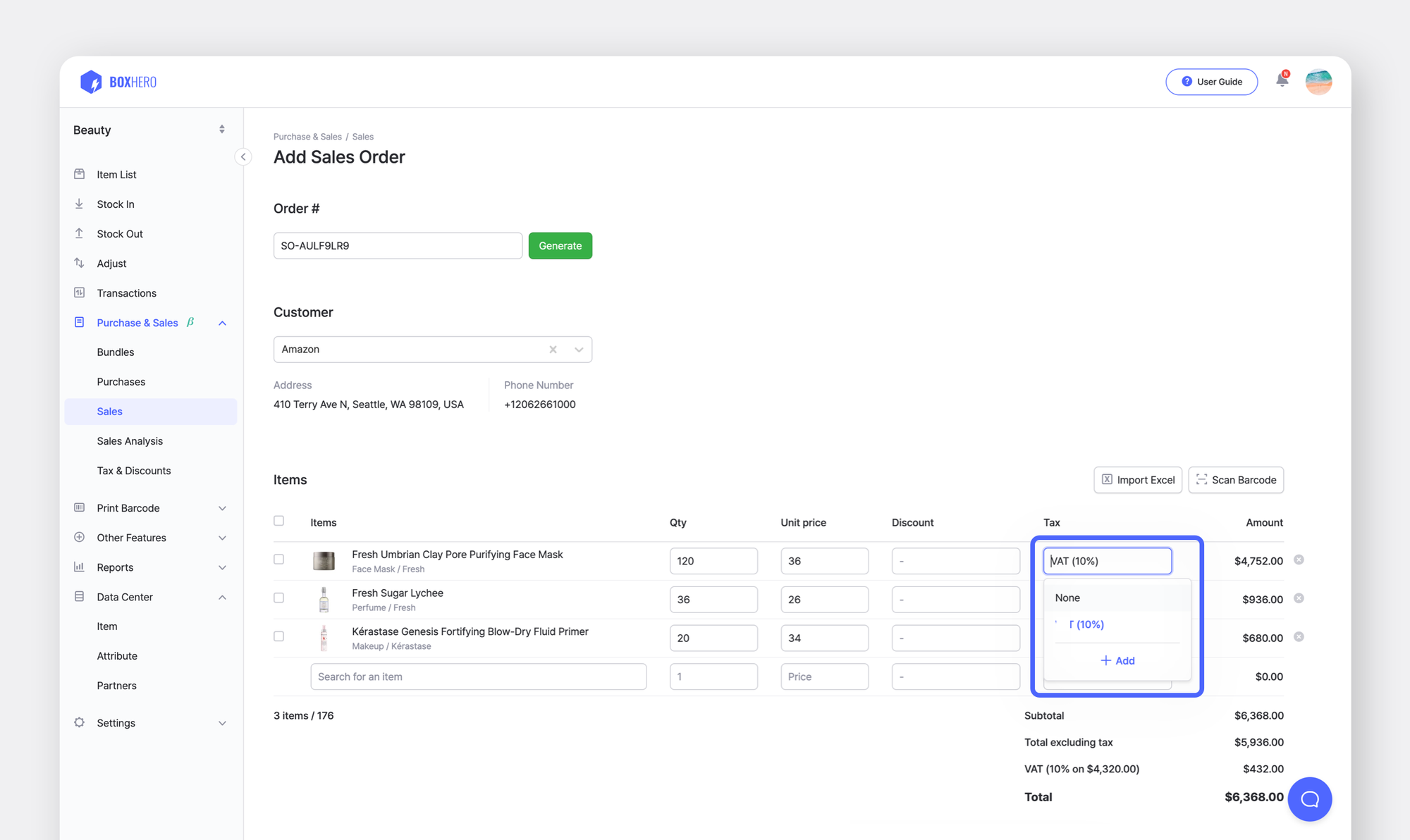

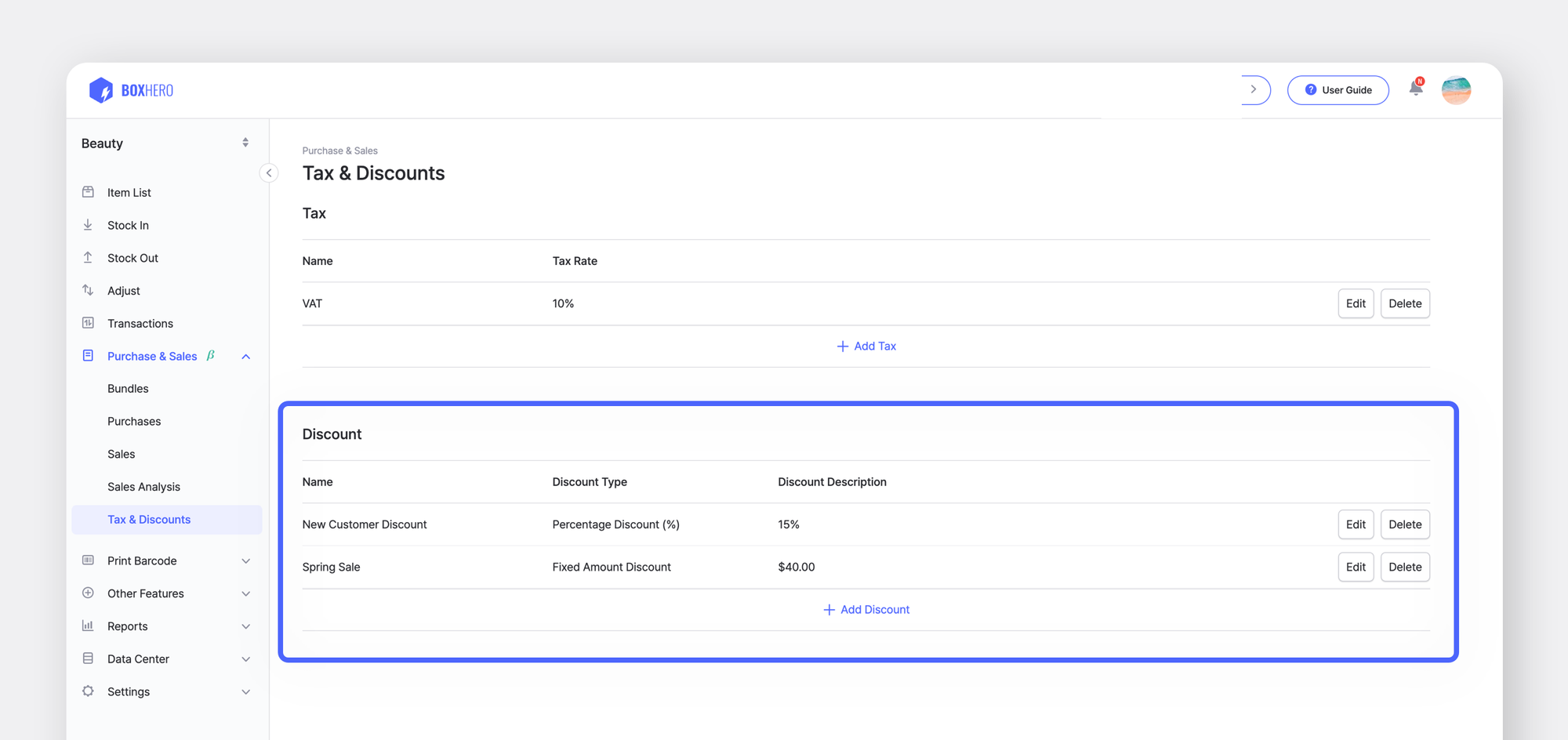

First, you need to specify the tax type in advance in Purchases & Sales > Tax & Discounts + Add Tax, and then enter the name of the tax type and the tax rate. If your sales price doesn't include taxes, select Exclusive, and if your sales price does, select Inclusive.

Once you've specified the tax type once, you can easily apply taxes when you create a purchase order or sales invoice. Tap Add Purchase Order or Add Sales Order, and click the input field at the bottom of the tax area to apply tax to the purchase price or sales price.

+ Add.3️⃣ Applying discounts

In business, there are times when you don't sell things at full price. You might have flexible discounts for first-time buyers, seasonal discounts, and so on. It's a hassle to change the unit price of a product every time you list it. Take advantage of our latest updated discounts feature!

In Purchase & Sales > Tax & Discounts, you can apply two types of discounts to the unit price: a percentage discount and a flat discount. Here are some examples of percentage discounts and fixed amount discounts:

• Fixed amount discount: $100 discount

Applying discounts is the same as applying taxes: tap Add Purchase Order or Add Sales Order, and click the input field at the bottom of the discount area.

4️⃣ P&L analysis

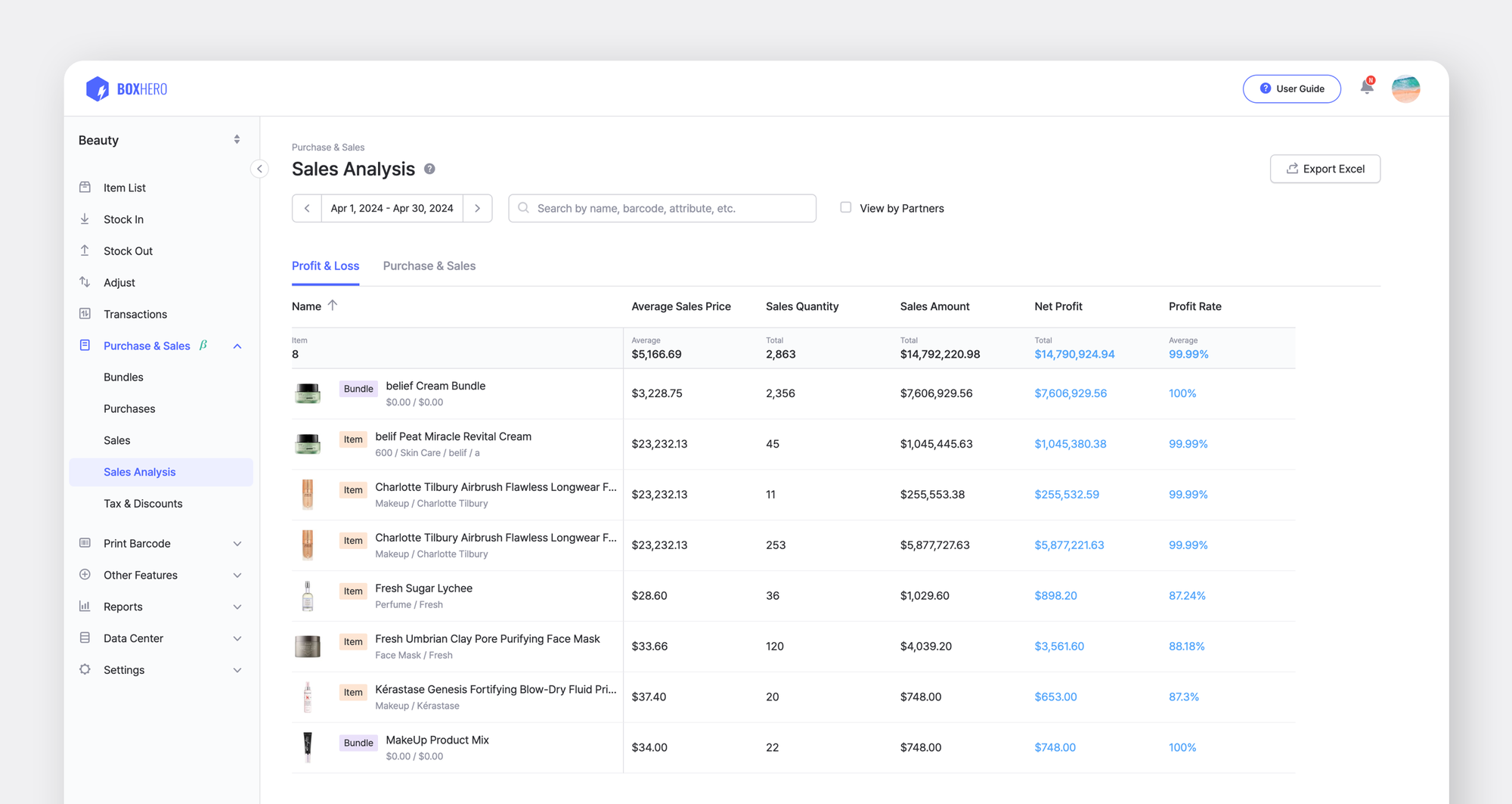

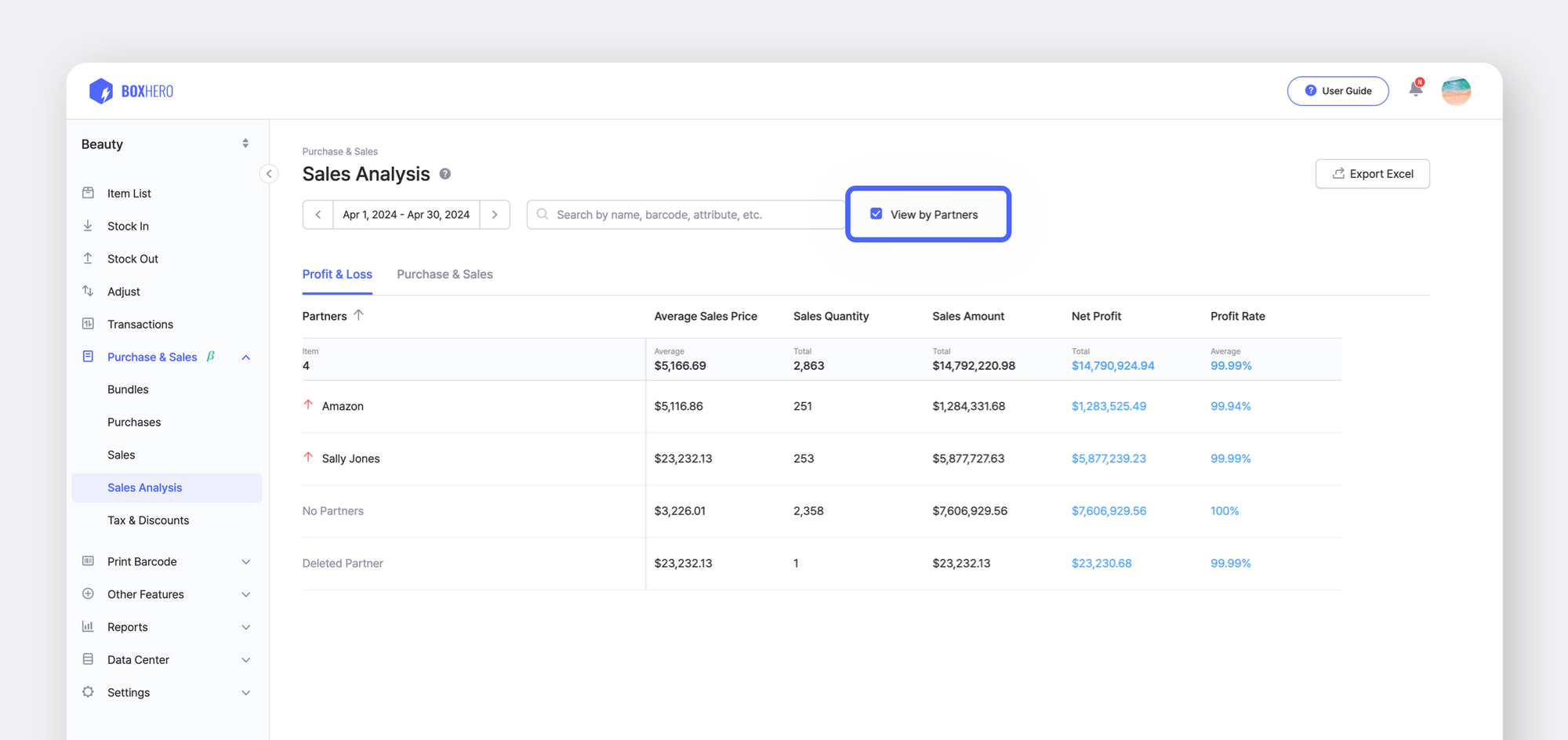

Profit and loss analysis is one of the key steps in financial management, as it allows you to make business decisions that maximize your financial performance. For an accurate profitability analysis, you need to be able to see basic data such as unit price and sales volume at a glance, and if you have multiple partners, you need to aggregate data for each partner.

It may seem difficult and complicated at first, but BoxHero makes it easy to see profit and loss analysis by period, product, and partner in Purchase & Sales > Sales Analysis. It automatically analyzes data such as average unit price, sales volume, revenue, gross profit, and gross margin without requiring you to do any calculations to get the metrics.

If you click the View by partners checkbox, you can review each partner's profit and loss individually - no need to get confused if you have multiple vendors or customers. See which ones have the highest profit margins and start planning your future business operations!

You don't need to look for a separate solution to manage your accounts receivable/payable anymore. Click the button below to try BoxHero's Purchase & Sales features for free today!